Personal finances

Personal finances

Income is all the money that goes into your bank account (pay, social security or other benefits from NAV, child benefit, cash-for-care benefit etc.).

Expenses are everything we spend money on (rent, interest and instalments, food, clothes, transport, electricity, internet, leisure activities etc.).

Gross pay: Pay before tax

Net pay: Pay after tax

Income and expenses

Living in Norway is expensive. Both parents in most families are in paid employment outside the home. In some families, the mother and/or father is able to work slightly reduced working hours while their children are young (part-time work), while many need full-time jobs to make ends meet. Both adults in a family are responsible for the family’s finances.

Most adults in Norway receive pay, social security or pension once a month. If there are children under the age of 18 in the family, they also receive child benefit. Parents receive the full cash-for-care benefit for young children who don’t go to kindergarten.

Child benefit: Financial support paid for all children under 18 years of age who are resident in Norway. It is intended to help to cover the expenses that come with having a child.

The cash-for-care benefit: Financial support paid for all children between 13 and 19 months who do not attend kindergarten. Reduced benefit is paid for children with a part-time kindergarten place.

You can find information about child benefit and cash-for-care benefit on NAV’s website.

Bank account

All adults in Norway have their own bank account. Many children and young people also have accounts. When we receive pay, social security or pension, the money goes straight into our bank account. You need a Norwegian personal identity number or a Norwegian D-number to open a bank account.

Online banking

Most adults use online banking. This makes it easy to maintain an overview of your bank account, keep an eye on income and expenses and pay bills. You can access online banking on a computer, tablet or a smart phone. You need BankID or a code generator to log into your online bank.

Bank loans

In Norway, it is common to borrow money from a bank to buy big things like a home or car. When we borrow money, we set up an agreement with the bank. We are given a repayment schedule showing how much we have to pay per month or per quarter. We pay instalments and interest to the bank.

Instalments: What we pay on the loan itself, i.e. down payments on the loan.

Interest: We pay interest to the bank. Interest is the cost of borrowing money. Interest is calculated as a percentage of the loan.

We normally pay instalments and interest every month or every quarter.

Budget

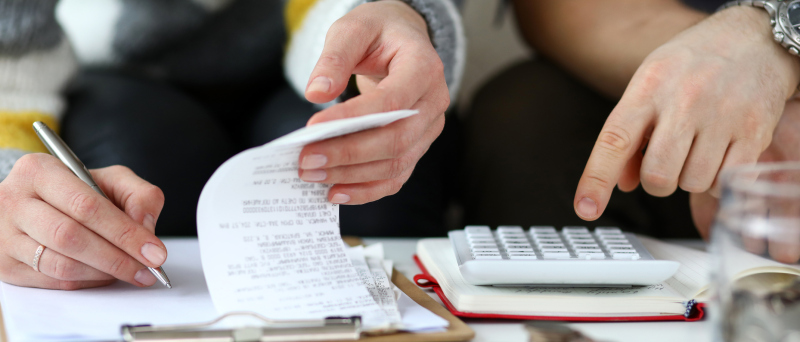

A budget shows income and expenses for a given period. Both companies and private individuals draw up budgets. Many families draw up a budget every month. This makes it easier to maintain an overview of income and expenses. Families can then plan how they are going to spend their money. A budget should include money that can be set aside every month for savings or unforeseen expenses.

Talk together

- What income and expenses does an ordinary family in Norway have?

- What unforeseen expenses could there be?

- What do you spend most money on?

- What could you do to spend less money?

The Berg family are sitting together in the living room. The mother and father have drawn up a budget of income and expenses for the month. When all the necessary expenses have been paid, they are left with around NOK 4,000. They’re now talking about what they're going to spend this money on.

- The mother would like a new winter coat. Her old one is unfashionable and worn out.

- The father would like to save the money. Unforeseen expenses could arise?

- The son would like to go to football practice with his friends. He needs new football boots too.

- The daughter needs a new school bag. She has grown too and needs new clothes.

Talk together about how the family should prioritise spending the money.

Select the right answer

What is income?

Select the right answer

What is gross pay?

Select the right answer

What is a budget?

Select right or wrong

Read the statements. What is right? What is wrong?

Select right or wrong

Read the statements. What is right? What is wrong?